Let’s be real watching your competitors can feel like running behind a moving train. But here’s the truth: competitive product analysis isn’t optional. It’s survival. Ignore it and you’ll miss blind spots, overlook customer frustrations, and guess your way through decisions your competitors are making with precision.

Think of it like walking a trail your competitor mapped years ago… except now you have better shoes and a GPS. Ready? Let’s dig in.

Identify Your Competitors

Before you break down someone else’s product, you first need to know exactly who you’re competing against. It’s not always obvious. Some competitors are loud; others hide in different categories or channels but still solve the same problem.

Types of Competitors

1. Direct Competitors

They offer nearly the same product to the same customer.

Spotify vs. Apple Music. Clear, head-on competition.

2. Indirect Competitors

They solve the same need but in a different way.

YouTube tutorials vs. paid online courses.

A meditation app vs. a therapist.

Different methods. Same outcome.

3. Emerging or Substitute Competitors

These are the ones you never see coming.

They solve the same problem with a fresh, modern twist.

Blockbuster didn’t lose to “better VHS tapes.” It lost to Netflix’s format shift.

How to Spot Them

Time to look under the hood.

- Google + SEO Tools: Search for what your product does. Ahrefs, SEMrush, and SimilarWeb will show you who else customers discover.

- Customer Insights: Ask your users what alternatives they considered. The surprises are often gold.

- Marketplaces + Communities: Amazon reviews, Etsy listings, Reddit threads, Quora discussions they reveal competitors you didn’t even know existed.

- Sales & Support Teams: These teams hear the comparisons daily. Leverage that intel.

Once you know who you’re up against, the real work begins.

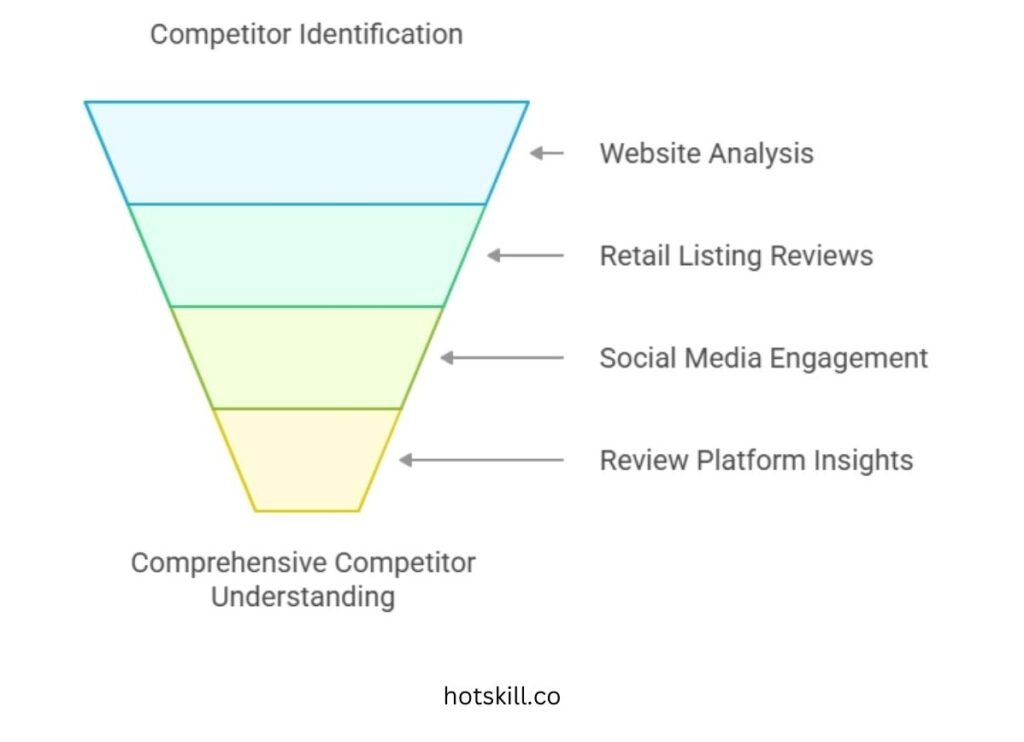

Gather Competitor Product Information

Now move from spotting competitors to understanding them. You’re not collecting features you’re decoding the full experience.

Where to Look

Get curious. Extremely curious.

- Websites: How do they speak? Who are they trying to attract? What pain points do they highlight?

- Retail or App Listings: Read reviews especially the 2–4 star ones. They’re brutally honest.

- Social Media: What resonates? Which posts take off? How are customers engaging?

- Review Platforms:

- Tech: G2, Capterra, TrustRadius

- Consumer goods: Thingtesting

- Electronics: rtings.com

- Enterprise: Gartner Peer Insights, Forrester

Dry? Maybe. But the insights aren’t.

Got your data? Great. Now interpret it.

Analyze Product Features and Quality

Here’s where theory meets reality. You’re not just benchmarking you’re experiencing what your competitors offer.

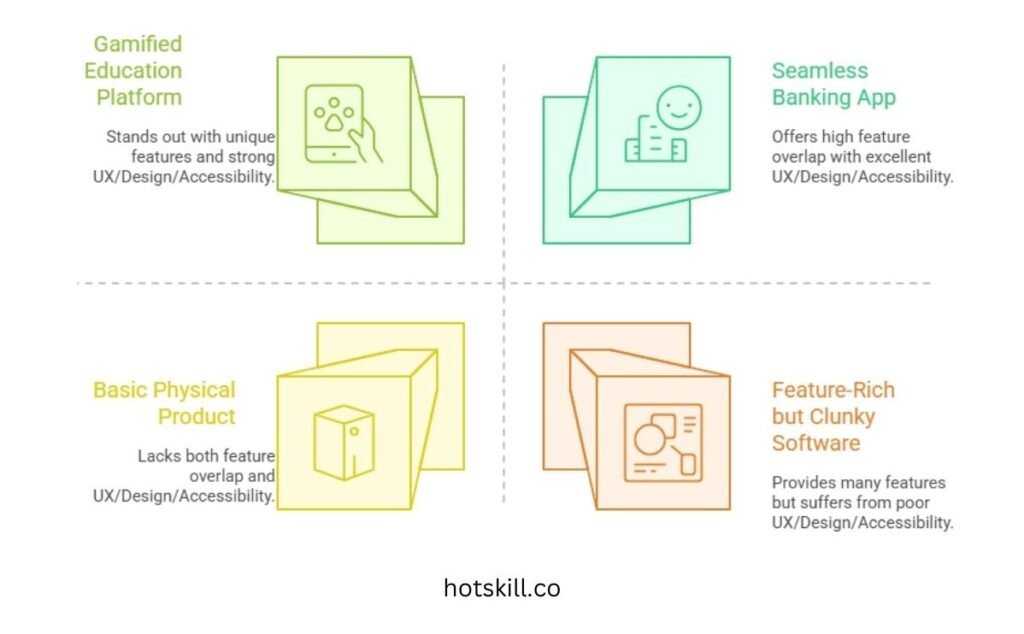

Side-by-Side Feature Analysis

Create a comparison table:

- What features overlap?

- Where do they outperform you?

- What’s your genuine moat?

Small, functional details often win loyalty:

- Faster onboarding

- Clearer navigation

- An “undo” button SaaS users swear by

- A more intuitive dashboard from the first click

In education, one platform might gamify lessons, while another offers 1:1 mentorship. Which aligns more closely with customer habits?

Small wins matter. Sometimes more than loud features.

UX, Design & Accessibility

Use their product. Really use it.

Ask yourself:

- Is onboarding smooth or confusing?

- Is the product accessible for users with disabilities?

- Does it work seamlessly across devices?

- What feels slow, broken, or pleasantly surprising?

Two banking apps may offer identical features. But the one with frictionless flows, satisfying haptics, and zero crashes?

That’s the one people trust.

For Physical Products

Buy the product. Unbox it. Use it for a week.

Observe:

- Build quality

- Material feel

- Durability

- Brand consistency vs. reality

A brand claiming “luxury” but shipping a candle in a dented tin? That’s not premium. That’s a missed opportunity.

Evaluate Pricing Strategy

Pricing communicates more than cost it communicates value, positioning, and expectations.

Look at Their Model

- Freemium?

- One-time purchase?

- Subscription tiers?

- Usage-based pricing?

- Enterprise quotes?

Canva is a great example: a generous free tier + natural, value-filled upgrades.

Sales, Promotions & Discounts

Track how often discounts appear—and who they target.

- Seasonal sales

- Referral bonuses

- Product bundle offers

- Limited-time tests

You’ll understand the audience segments they’re actively trying to convert or retain.

Study Customer Feedback and Reviews

Want the truth? Skip the landing page. Read the reviews.

Spot Consistent Patterns

Look for:

- Recurring praise

- Persistent complaints

- Promises that don’t match reality

- Requests customers keep repeating

“Love the features but the app crashes constantly” → That’s a churn signal.

“I wish there were more breathing exercises” → That’s a roadmap opportunity.

Use that directly in your own product and messaging.

Assess Marketing and Positioning

Great product + bad story = weak results.

Average product + great story = growth.

Evaluate Messaging

- Are they data-driven or emotion-led?

- Product-first or vision-first?

- Speaking to beginners or advanced users?

Two wellness brands may sell identical supplements. But one promises “science-backed clarity,” while the other says “feel like yourself again.”

Same product. Different world.

Channels They Use

Where are they winning attention?

- TikTok? Instagram? LinkedIn?

- SEO content?

- YouTube tutorials?

- Webinars?

- Community building?

- Influencer partnerships?

Where they are loud and where they’re silent shows your opportunities.

Analyze Distribution & Sales Channels

A great product fails if customers can’t buy it easily.

Where Are They Selling?

- DTC website?

- Amazon?

- Retail stores?

- Global marketplaces?

- Local-first or worldwide?

- App stores?

Glossier lived online until Sephora multiplied its visibility.

Distribution isn’t luck it’s strategy.

Benchmark Performance Metrics

Now give all your observations some numerical backbone.

What to Track

- Traffic estimates (via SimilarWeb or Ahrefs)

- Market share (public sources, industry reports)

- Pricing changes

- Update frequency in SaaS

- Engagement metrics on social platforms

- Ad spend signals (using Meta Ad Library, Google Ads Transparency)

These numbers help contextualize everything you learned.

Use Competitive Analysis Tools

Manual work is useful but not scalable. Let tools do the heavy lifting.

Tools That Matter

SEO

- Ahrefs, SEMrush, Moz

Review Aggregation

- Trustpilot, G2, Capterra

Social Listening

- Brandwatch

- Sprout Social

- Even simple Google Alerts

Market Discovery

- Product Hunt

- AppSumo

- Crunchbase

- CB Insights

They help you track competitor activities long-term not just during research spikes.

Draw Insights and Apply Findings

Data is useless unless it changes something.

What to Do With Your Analysis

- Close feature gaps that genuinely matter

- Double down on features customers love

- Fix what your competitors ignore

- Rewrite messaging to directly address unmet needs

- Improve your onboarding and support

- Shift pricing to better match perceived value

If your competitor’s biggest complaint is “terrible support,” make yours unforgettable and talk about it everywhere.

Once you know the weaknesses in your market, you can design a strategy that feels effortless.

Conclusion: Anticipate, Don’t Just Adapt

Competitor analysis isn’t about copying it’s about clarity.

Markets evolve. Customers evolve. Technology evolves.

If you’re only reacting, you’re already behind.

Build this into your rhythm monthly, quarterly, or with every new product initiative.

Use your findings to:

- Outthink,

- Outbuild,

- Outsupport, and

- Outcommunicate your competitors.

Not to follow them but to set the pace.