Introduction

Coming up with something brand new? It’s a wild ride. A burst of excitement hits maybe it came to you mid-commute or while brushing your teeth. You’re buzzed. But then comes that little voice in your head:

Will anyone actually care?

That’s conduct market research steps in. Not to rain on your idea, but to make sure you’re not building a rocket that no one wants to ride. Think of it like headlights on a dark road. It won’t drive the car for you, but it’ll show you where you’re going.

And honestly, it’d be reckless not to pause. Because here’s the reality—around 70% of new products fail. Yeah, you read that right. Most tumble face-first into the market and vanish.

But here’s the upside: when research is done right, it stacks the odds in your favor. Companies that take the time to really understand their users tend to launch products that hit, spread, and stick. Whether you’re crafting herbal energy drinks, designing a budgeting app, or launching sneakers made from banana fibers, the research map looks surprisingly familiar.

Let’s break it down together.

Step 1: Define the Objective

You’ve got to figure out what you’re even trying to learn. Simple, but often skipped.

Ask yourself:

- What problem are we actually solving?

- Who do we think has this problem?

- What are we assuming (and hoping) to be true?

- What do we need to know before spending real time or money?

Let’s say you’re building an AI tool for overworked doctors. The objective? Understand how open they really are to new tech. Do they trust it? Do they worry it’ll eat more of their time?

Or maybe you’re reimagining subscription boxes. Are people still into surprises, or has the trend moved toward hyper-personalization?

If you get this wrong, everything downstream gets weird. You’ll collect data that doesn’t help you decide anything. And that’s just a waste.

Step 2: Identify the Target Audience

Not everyone is your customer. And honestly? That’s a huge relief.

We’ve seen founders try to be everything to everyone; it dilutes everything. You need clarity, not chaos. Locking in your audience lets you craft better questions and recognize more relevant patterns in the answers.

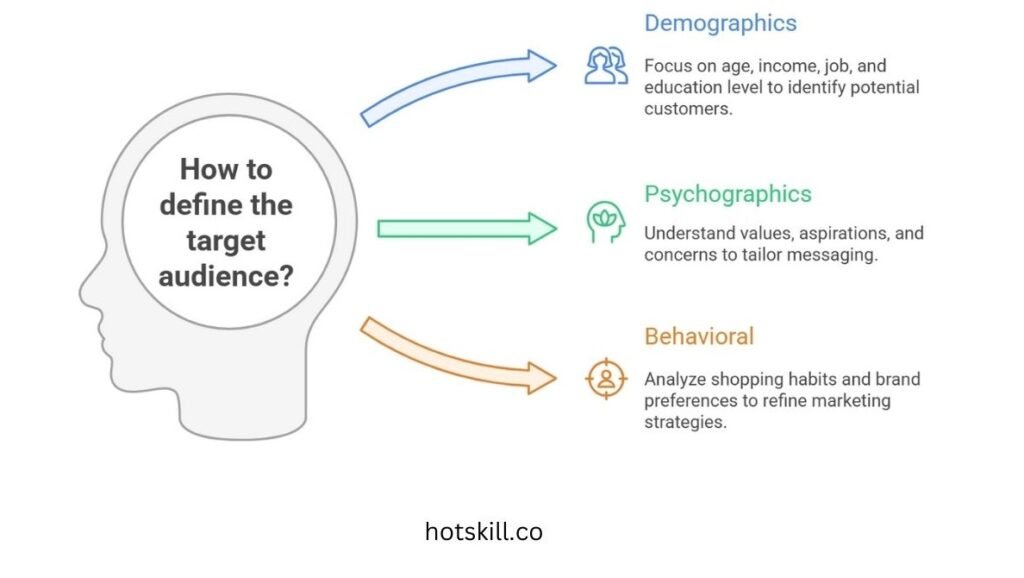

There are a few ways you can slice things:

- Demographics: Think age, income, job, education level.

- Psychographics: What are they striving for? What do they value? What keeps them up at night?

- Behavioral: How do they shop? What brands do they ghost or swear by? Are they impulsive or methodical?

Let’s say you’re building a meditation app. Instead of “people who want to relax,” dial in on 25 to 40-year-old professionals who’ve tried Headspace but fell off after three days. That’s someone you can actually talk to.

Or maybe it’s a study tool for high schoolers. Don’t lump “students” together. Students and their parents see the same tool in wildly different ways.

It’s not about cutting people out. It’s about getting clear enough to know how to speak their language.

Step 3: Choose the Research Method

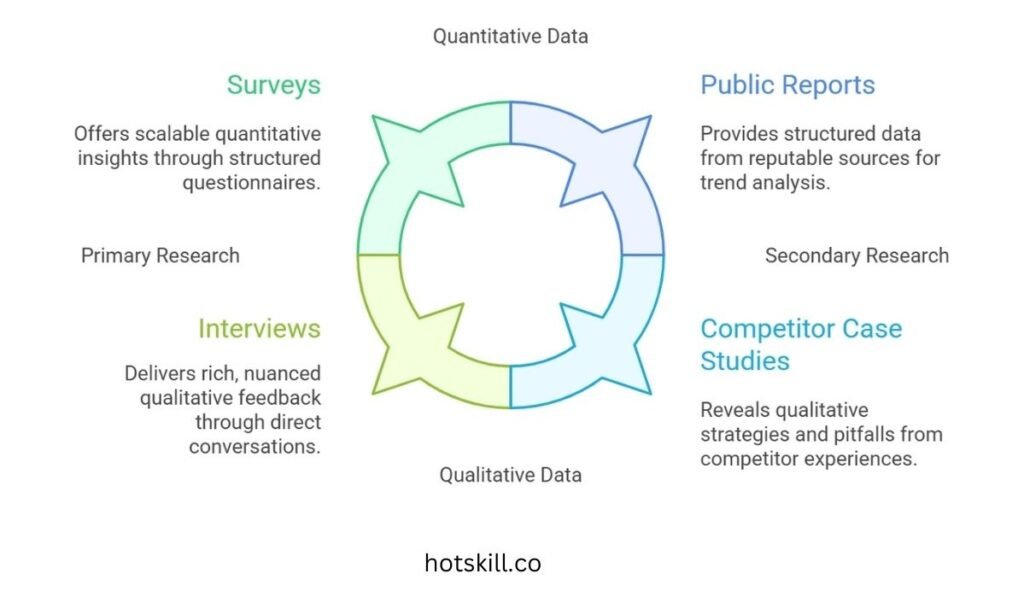

Now that you know what you want to learn and from whom, let’s talk about tools. You’ve got two main options: dig for fresh data yourself, or pull existing data from smart people who’ve already poked at similar questions.

Most good research mixes both. Think of it like cooking dinner with fresh produce, but also adding some canned beans from the pantry.

Primary Research

You’re doing the legwork here. Talking to people. Collecting answers directly.

- Surveys: Quick and scalable. Kind of a blunt instrument but useful for spotting trends. Tools like Google Forms or Typeform make this easy.

- Interviews: One-on-one conversations = gold. You’ll hear tone shifts, hesitation, excitement—that rich stuff can’t be graphed.

- Focus Groups: Small curated groups. Great for bouncing ideas around and revealing blind spots, especially if you’re testing marketing language or early designs.

Let’s say you’re in fintech. Talk to people who’ve recently moved their bank accounts. Why did they switch? What pissed them off enough to leave? You won’t get that from spreadsheet data.

Secondary Research

Let others’ sweat do some of the lifting.

- Public Reports: McKinsey, Statista, or Pew can give you real numbers and direction.

- Competitor Case Studies: What’s working for them? Where are they fumbling?

- Industry Forums and Threads: Sometimes, Reddit posts teach you more than whitepapers.

Say you’re developing a sustainability product. The World Economic Forum’s data on environmental concern trends can open your eyes to which demographics are actually putting their money where their mouth is.

Do both. One shows you what people said when you asked. The other tells you what the world’s already found out.

Step 4: Design the Research Instrument

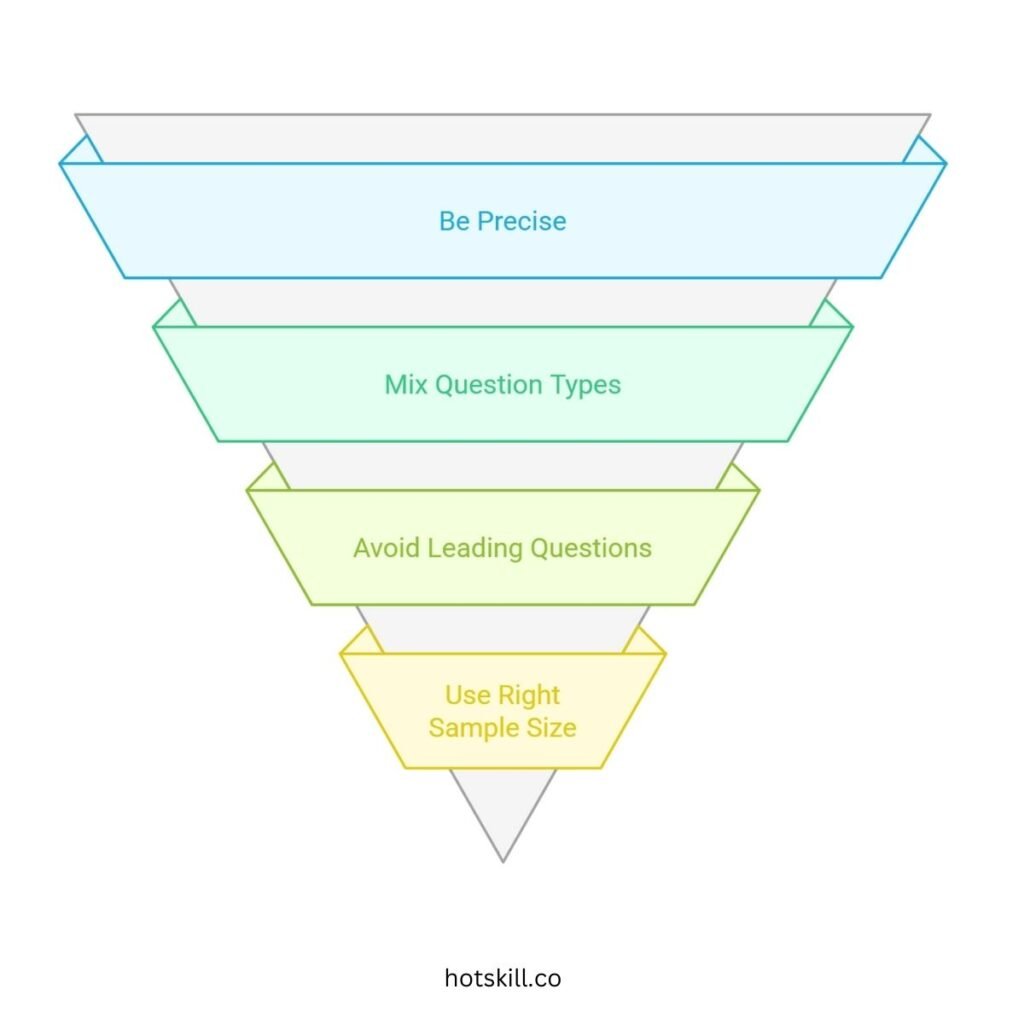

This is where most people mess up. Because you can have the right audience and a crystal-clear goal…and then ask the wrong questions.

So here’s what helps:

- Be precise. “How often do you eat plant-based meals?” > “Do you like healthy food?”

- Mix it up. Use multiple choice for trends, but open-ended follow-ups for exploration.

- Avoid leading questions. Don’t say “How annoying is it…?” unless you’re okay nudging people.

- Use the right sample size. For surveys, go for a big 100 responses minimum if you want patterns. For interviews? Even 7 solid chats can reveal consistencies.

Here’s something cool: a major CPG brand wanted to understand eco-conscious moms aged 30 to 50. They crafted a simple, honest survey and got a 34% completion rate. That’s wild in survey land. Those insights completely reshaped their packaging.

Step 5: Collect the Data

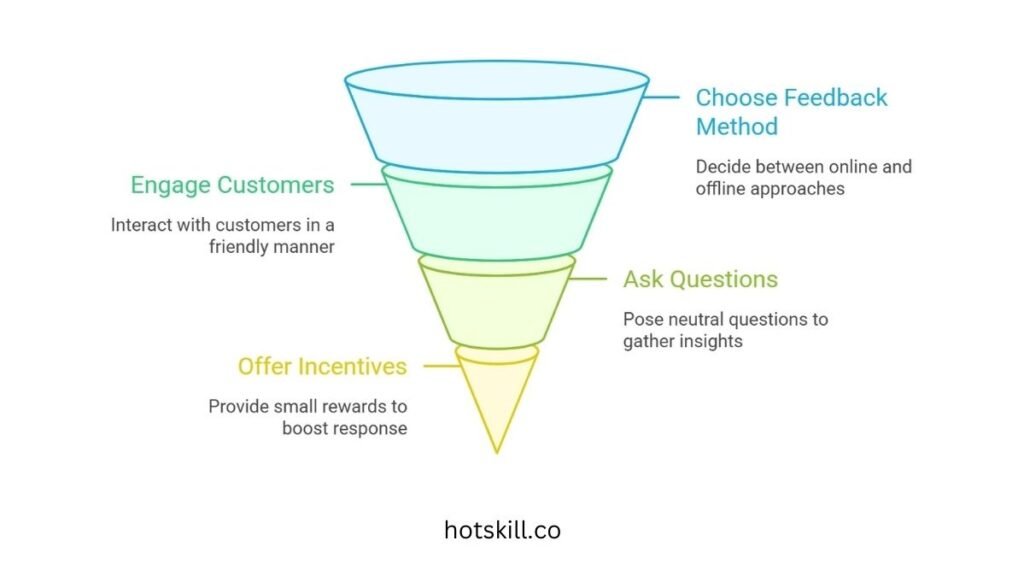

Alright. Time to go into the wild.

There are two ways to get answers digital or face-to-face.

- Online: Email blasts, social media, website pop-ups. Use tools like Typeform, and keep it snappy.

- Offline: Don’t sleep on this. Chatting with folks at coffee shops, quick intercept interviews at farmer’s markets, or QR codes at events even those tap into real, spontaneous feedback.

A few things to remember:

- Speak like a human. No one wants to decode corporate-speak.

- Ease your way in. Start simple to build trust.

- Don’t force your agenda. Stay neutral. Just ask.

- Offer a little something. A small discount, gift card, or sneak peek can double your response rate.

You’re not trying to tally up opinions. You’re listening for signals from real people with real lives.

Step 6: Analyze the Data

Now the messy spreadsheet and scribbled notes need to become something useful.

Quantitative Analysis

Break out Excel or Google Sheets. Or SPSS or R, if you lean nerdy.

Start here:

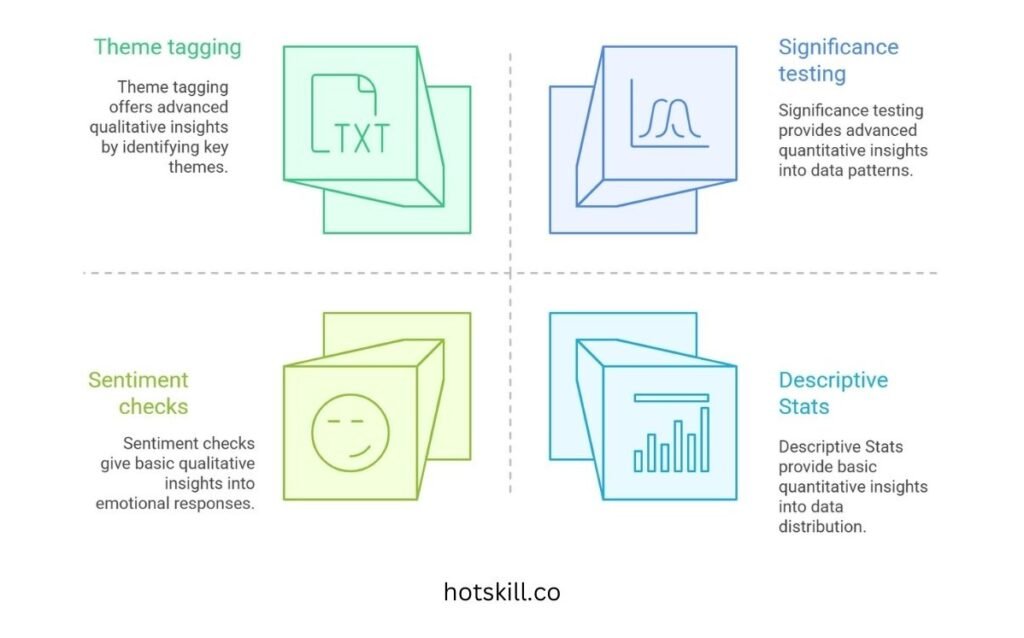

- Descriptive Stats: What are the highs, lows, medians? These give you the lay of the land.

- Cross-tabs: Slice answers by age, job type, whatever matters. You’ll spot differences between groups.

- Significance testing: Did that 45% spike in interest among Gen Z actually mean something? Stats help you tell random from real.

Quick example: a hotel chain found that 62% of weekend travelers liked sustainable lodging. But among millennials, it spiked to 78%. That changed their marketing completely.

Qualitative Analysis

This is where context lives. And emotion.

- Theme tagging: Highlight key words in transcripts. Group those into big ideas.

- Sentiment checks: Do people sound excited? Confused? Skeptical?

- Pain point logs: If three interviewees say the sign-up process sucks, believe them.

In one edtech test, students kept saying they got “stuck” on lessons. So the team added video hints mid-experience. Engagement jumped 22% in two weeks.

Look for patterns. Echoes. That’s where the insight lives.

Step 7: Interpret and Report Findings

Now you’ve got your insights. But turning them into action and making people actually care? That’s a skill too.

Here’s a format that works:

- Executive Summary: Keep it tight. One to two pages with juicy takeaways.

- Breakouts by Theme: Group by pain points, desired features, buying barriers—whatever makes sense.

- Visuals Matter: Line graphs, pie charts, word clouds. Humans are wired for images.

- Bridge to Strategy: Spell it out. “Users want fast sign-up. We’re cutting steps below three screens.” That kind of clarity.

A drink startup did this. They found that 41% of Gen Z consumers preferred sugar-free options, but cared even more about ingredients that “do something.” They launched a zero-cal vitamin-infused line…and pulled in $2 million their first year.

That’s not trivia. That’s traction.

Step 8: Make Informed Business Decisions

Here’s the moment where thinking turns into building.

Use your findings to shape:

- Product Features: Add what matters. Cut what doesn’t spark interest.

- Price Point Tests: See where users bail. Use this data to find that sweet spot.

- Positioning: Don’t just say “quality tech.” Say “AI that takes five minutes off your chaos.” That’s sticky.

- Launch Channels: Figure out where your people hang out. And how they prefer to buy.

We’ve seen digital banks overhaul their onboarding just by deep-diving into user feedback. One even reworked their entire tone less financial lingo, more plain, human reassurance. Customer trust shot up.

That’s the power of a 4% shift in insight. The kind of tiny edge that silently separates winners from flops.

Conclusion

Here’s the thing… no product idea, no matter how genius, should go to market blind.

Market research isn’t about chasing perfection. It’s about anchoring your next steps in something real. Grounded. Tested.

This process from aiming your questions to talking to people, making sense of the chaos, and acting on actual needs isn’t optional anymore. It’s your secret weapon. Whether you’re in wellness, education, finance, or food.

And remember, it’s not a one-time checklist. It’s a recurring habit. A loop. The market moves fast. So the ones that stay curious and keep asking those are the ones that stay standing, wallet open, customers in line.

Keep talking to your users. Listen for the ripple behind the words.

Your hunches matter. Your creativity too. But don’t build on pure gut. That final 4% that edge comes from real voices, real needs, and real insight.